In today’s generation, Earning money is important, but Money management it is equally important. Many people think that since they haven’t done any financial course, how can they manage their money? But don’t worry, you don’t need any financial course or money management degree for this. When you’ve just started earning—whether you are a student, a young adult, or a new earner — Money management might seem tricky or confusing, but it’s not rocket science. You can learn it easily.

Questions like “What is money management?”, “How do I plan my monthly spending?”, “How much should I save?”, and “Where should I save?” come to every beginner’s mind, but most avoid them. Don’t worry now—this article is specially made for beginners where we will explain everything step-by-step with 5 money management tips for beginners, from basic to advanced. We will give your financial life a strong foundation. The tips I share won’t just cover daily expenses but will guide you towards lifetime savings and investments. You will be able to achieve lifelong financial freedom.

Whether you just started a job or are a student wanting to use your pocket money wisely, this article is for you. These 5 money management tips for beginners could be life – changing. So without wasting time, let’s get into the basics.

What is Money Management?

Money management means planning and handling your money wisely — including spending, saving, and investing it in a way that helps you reach your financial goals and long-term security. It helps you avoid unnecessary debt and brings you closer to financial freedom.

It’s not just about spending less, but about building smart daily habits and following a systematic process. This includes tracking your income, setting a budget, saving regularly, managing debt, and being prepared for emergencies.

Learning these basics will help you throughout life — no matter your age or income.

Key Elements of Money Management:

- Income Tracking : Keeping track of how much money you earn.

- Budgeting : Creating a spending plan to control your finances.

- Saving : Regularly putting money aside for future needs.

- Investing : Growing your wealth by putting money into assets like mutual funds, stocks.

- Expense Tracking : Monitoring where your money goes.

- Debt Management : Keeping your loans and credit card use under control.

Here are 5 Money management tips for beginners.

1. Track Every Dollar You Spend

Are you one of those who spend freely at the start of the month but wonder at the end, “Where did the money go?” If yes, this tip is just for you.

Until you know where your money is going, you can’t start saving, investing, or controlling your finances. Start tracking every small expense—whether it’s a ₹20 tea or ₹2000 online shopping.

Why this habit matters:

- You become financially aware

- You understand unnecessary expenses

- Savings and investments grow naturally

- Without tracking, everything seems fine, but by month-end you realize: “What all did I spend!”

How to track your spending:

- Use Budgeting Apps:

Try apps like Walnut, ET Money, Spendee, Money Manager, GoodBudget.

These apps automatically categorize your expenses (Food, Travel, Bills, etc.). - Use Google Sheets or a Notebook:

Write your daily or weekly expenses by category:- Food & Drinks (Swiggy, Snacks, Café)

- Transport (Petrol, Ola, Uber)

- Bills/Rent (Electricity, Rent)

- Subscriptions (Netflix, Spotify)

- Savings (SIPs, FD)

- Make It a Daily Habit:

Spend 10-15 minutes daily (night time is best). Write down all cash, card, or UPI expenses. In 3 weeks, this will become a habit and you’ll be among the 5% who manage money smartly.

Benefits of expense tracking:

- Full financial control

- Increase in savings & investments

- Reduced unnecessary expenses

- Better real-time budgeting

Real-Life Example:

Think you spent only ₹500 on coffee/tea in a month? Tracking might shock you—it could be as much as ₹2000! Imagine if you had invested that in SIPs?

2. Pay Yourself First — Save Before You Spend

“Pay Yourself First” is a powerful money management principle followed by every financially successful person. Simply put, as soon as you get your income or pocket money, save or invest first—then spend the rest.

Why is this important?

Most people spend throughout the month and hope to save at the end—but they don’t! If you save or invest a fixed percentage first, you will:

- Feel financially stable

- Benefit from compounding

- Enjoy a stress-free life

How to start — simple steps:

- Fix a saving percentage right when income arrives:

- Beginner: 10%

- Intermediate: 20-30%

- Aggressive/Single: 50%+

Whether salary, freelance income, or bonus—save/invest a fixed percentage.

- Set up auto-saving:

- Arrange auto-transfer from your salary account to SIP, FD, or another savings account.

- Choose a fixed date (1-2 days after salary).

- Treat this money as already spent—don’t touch it.

Real-Life Example:

Person A | Person B |

Earns ₹20,000 | Earns ₹20,000 |

Spends first | Saves ₹4,000 first |

No savings left | ₹4,000 secured every month |

Stressed | Financially confident |

Regret after 5 years | ₹2.4L + interest after 5 years |

Final Thought:

Earning money is important, but managing it smartly is real intelligence. Some people earn a lot but save nothing, while others with less income build big assets. Start today—little by little. Pay yourself first; then spend. This habit can truly change your financial future.

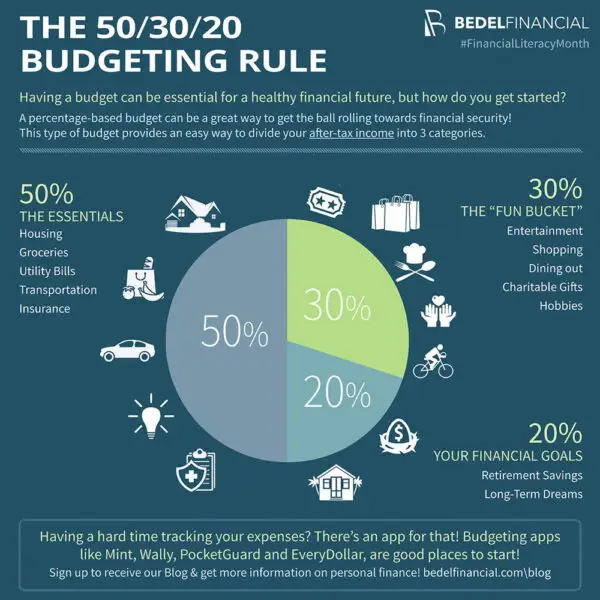

Many find budgeting boring or time-consuming, but if you want to manage money smartly and simply, the 50/30/20 rule is perfect. It’s easy and effective, letting you divide your money smartly every month without overthinking.

- 50% for Needs — Basic Essentials

Use 50% of your income for essential daily survival expenses:

Rent, groceries, electricity, transport, school fees, insurance, minimum loan EMIs.

Note: If your needs are over 50%, you need to cut costs. - 30% for Wants — Lifestyle & Luxuries

These are not essential but for enjoyment:

Movies, Netflix, dining out, parties, gadgets, shopping.

Keep wants to 30% or less of your income. - 20% for Savings & Investments — Your Future

This part is for financial growth and security:

Emergency fund, SIPs, mutual funds, PPF, fixed deposits, loan prepayment.

This is not optional—make it compulsory. Start small if income is low.

Example for ₹30,000 income:

Category | Amount | Covers |

Needs | ₹15,000 | Rent, bills, groceries, transport |

Wants | ₹9,000 | Food, movies, lifestyle |

Savings | ₹6,000 | SIPs, emergency fund, loan repay |

Final Thought:

“Plan your money first, then spend.”

Follow this rule for 3-6 months and you’ll gain:

- Financial clarity

- Saving habits

- A step closer to financial freedom

You don’t have to follow the 50/30/20 rule exactly; adjust savings based on your goals. Stop overthinking and start managing your money smartly today!

4. Build an Emergency Fund — When Life Throws Surprises

Life can surprise you anytime—and not all surprises are good. That’s why every smart person has an Emergency fund—a backup saving used only in urgent situations.

What is an Emergency Fund?

It’s money reserved for:

- Job loss

- Medical emergencies

- Family crises

- Sudden travel

- Unexpected expenses

The biggest benefit? No need to borrow or use credit cards. Emergency fund = peace of mind + no debt traps.

Why it’s important:

- Financial independence

- Less stress

- No missed EMIs

- No dependence on others

How much should you keep?

Rule of thumb: Monthly expenses × 6 to 12 months

Example: If your monthly expense is ₹20,000, keep ₹1,20,000 as an emergency fund.

How to build it:

- Fixed monthly contribution: Even ₹500 or ₹5,000 consistently adds up.

- Choose the right place:

- Fixed Deposit (Safe + moderate interest)

- Liquid Mutual Funds (Easy access + better returns)

Make sure it’s easily accessible for emergencies.

- Use it only for real emergencies—not vacations or gadgets.

Final Thought:

Everyone needs an emergency fund, no matter income level. Start small, but start now.

“₹1,000 during a crisis feels like ₹10,000.” Plan today, build slowly, and be financially confident.

5. Learn Before You Invest

Many invest without knowledge or planning, and if money is lost, regret lasts a lifetime, and confidence vanishes. “Investment without knowledge is like a lottery—you’re more likely to lose.”

Why is learning important?

Each investment product has its own risk and return. The market has many frauds and fake tips that can harm your money. To get good returns, learning is necessary. For long-term growth, invest at the right time and place.

What to learn?

- Basic finance: Risk capacity, ROI, compounding, inflation

- Investment options: FD, stock market, gold, mutual funds

- Your risk level: Short-term vs. long-term goals

Common mistakes:

- Buying stocks without understanding

- Investing based only on results

- Ignoring risks

- Investing based on friends or relatives’ advice

Final thought:

Don’t invest just by watching others or listening to someone. First understand the market, then start with small amounts.

“Investment is not a rocket but like a train—slow but more effective.”

"Smart money management is not about how much you earn, but how wisely you use and grow it." — Anonymous

Use My Free Compound Calculator Tools for Your Future Growth: Money Calculator

Conclusion :

You don’t need to be a professional to Money management and manage your money. Remember, managing money is a skill anyone can learn anywhere. In today’s unpredictable world, money management is not a luxury but a necessity. Whether you’re a student, young professional, or business owner—if you don’t know how to manage money, no matter how much you earn, it goes to waste.

When you track all your expenses, pay yourself first, follow smart budgeting and investing rules, and don’t invest without knowledge—you’re not just saving money, you’re building a financially safe and independent life.